Blitz Report is a reporting software solution based on Oracle Forms and OAF pages, fully integrated with Oracle E-Business Suite, providing you easy access to your financial and manufacturing information.

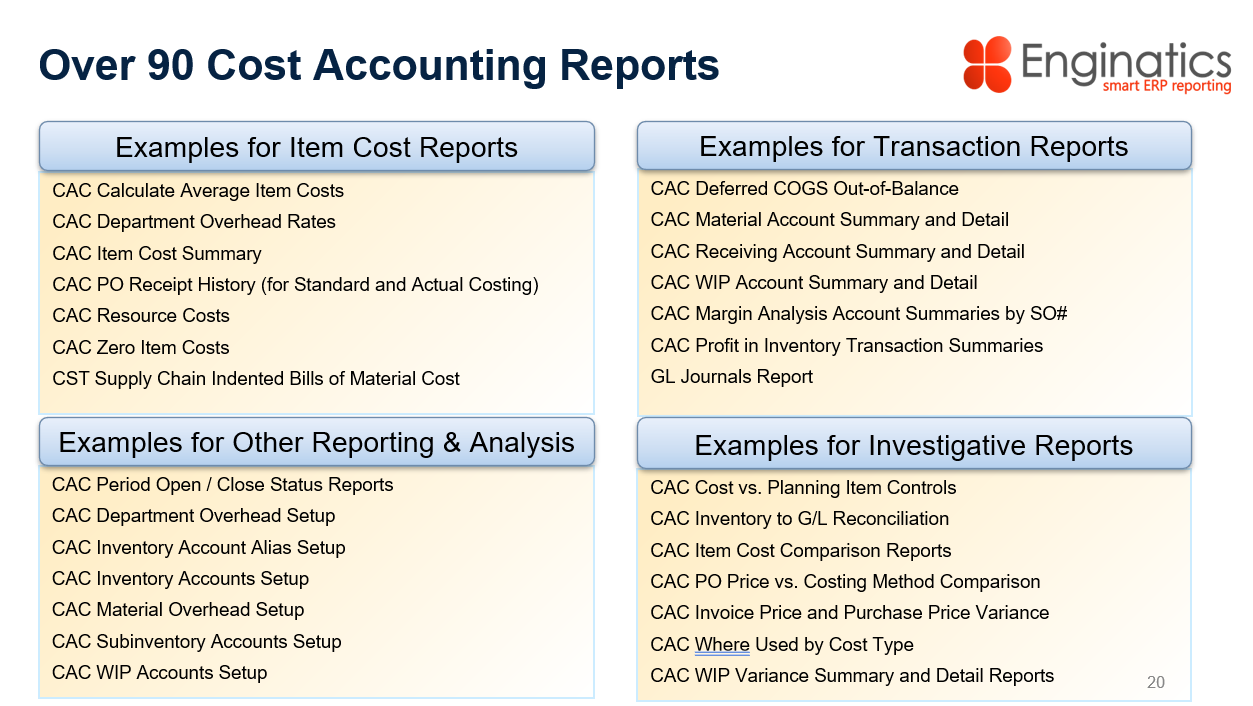

With over 90 fully configured cost accounting reports readily available in Blitz Report, multi-organization reports which download natively into Microsoft Excel, you can efficiently generate reports for most Oracle EBS configurations, including Project Manufacturing, Warehouse Management, as well as Category Accounting. All of these reports come preconfigured with default parameters, saving you time and effort in generating reports.

Cost accounting is an essential process for any company that wants to keep a close eye on its financial health. It involves the allocation of costs to various cost objects, such as products, services, and other activities that a company engages in. This helps a company identify where it is spending money, how much it earns, and where money is being lost. One of the most critical aspects of cost accounting is the use of reports that help track inventory valuation, item costing, transactions and other reports related to Oracle applications. Let’s explore these reports in more detail:

- Inventory Valuation Reports help track multi-organization inventory and WIP valuation, including reports to track profit in inventory valuation, intransit, onhand, receiving and work in process. With additional reports to easily compare your G/L inventory balance with your perpetual inventory balances at month-end. These reports are crucial in comparing accounting entries, finding out-of-balances, and tracking inventory across all inventory organizations.

- Item Costing Reports help manage and report your item cost inputs, from calculating average item costs over a specified date range, comparing item costs between inventory organizations, reporting item costs in summary or in detail, verifying resource and overhead rates, and even identifying cost rollup errors in advance. They also cover sourcing rules, internal sales order prices, and where-used analysis for both assemblies and components. There are also reports for tracking new items, calculating profit in inventory item costs, finding erroneous item costs, and comparing open POs to frozen standard or average costs.

- Transactions and Variances Reports cover areas such as Deferred COGS, material accounting entries, manufacturing variances, WIP transactions, and receiving accounting entries. They provide information on inventory organization, transaction type, accounting line type, cost element, and more. Some reports also allow for a comparison of actual and planned costs; others can also help identify potential G/L out-of-balance issues. The reports can be run across multiple inventory organizations and help with variance analysis, profit in inventory elimination, and validation of transacted COGS, margins, and inventory amounts.

- There are other important reports related to Oracle applications that provide information on inventory, operating units, ledgers, cost group accounts, department and overhead code assignments, intercompany relationships, account aliases, sales, purchase orders, resources, shipping network setups, and WIP accounting class accounts. They are useful for analyzing Oracle Apps setups, ensuring setups are complete, spotting errors, and tracking open orders and accounting periods.

Cost accounting is a vital process for any company that wants to understand its financial health. Reports such as inventory valuation reports, item costing reports, other reports related to Oracle applications, and transaction and variance reports are essential tools for tracking costs and identifying areas where a company can improve its financial performance. By using these reports, a company can make informed decisions that help it become more profitable and successful.